How Much House Can I Afford? Your Complete Mortgage Affordability Guide

Master the art of calculating your home buying budget with proven formulas, expert insights, and practical tools to make informed mortgage decisions.

Determining how much house you can afford is one of the most critical financial decisions you'll make. Whether you're a first-time homebuyer or looking to upgrade, understanding your borrowing capacity helps you avoid financial strain and find a home within your comfortable price range.

This comprehensive guide walks you through the key factors that determine mortgage affordability, the calculations lenders use, and practical steps to estimate your ideal home price using proven methodologies and accurate mortgage calculators.

Understanding Home Affordability: The Foundation

Home affordability refers to your ability to purchase and maintain a property without compromising your financial stability. It's not just about qualifying for a loan—it's about ensuring you can comfortably manage monthly payments alongside your other financial obligations and lifestyle needs.

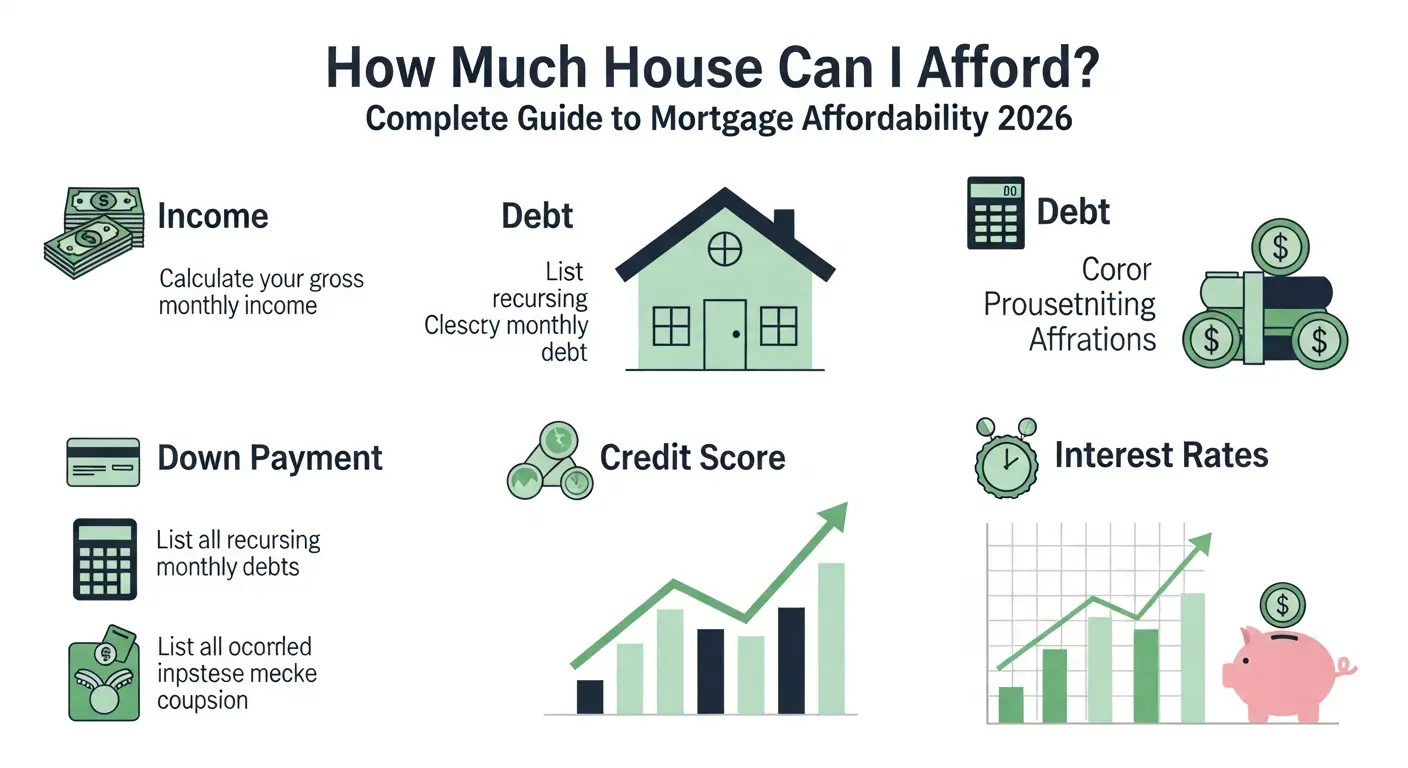

Key Factors That Determine Affordability

- Gross Monthly Income: Your total pre-tax household earnings form the baseline for all affordability calculations

- Existing Debt Obligations: Current loans, credit card payments, car loans, and other recurring debts directly impact borrowing capacity

- Down Payment Amount: A larger down payment reduces loan principal and improves affordability

- Credit Score: Higher scores unlock better interest rates and more favorable loan terms

- Interest Rate: Even small rate differences significantly impact monthly payments and total loan cost

- Loan Term: Longer terms (30 years) mean lower monthly payments but higher total interest paid

The 28/36 Rule: Industry Standard for Mortgage Qualification

Lenders commonly use the 28/36 rule as a guideline to assess mortgage applications. This rule helps ensure borrowers don't overextend themselves financially.

Front-End Ratio: 28%

Your housing expenses should not exceed 28% of gross monthly income

Includes: Mortgage payment (principal + interest), property taxes, homeowners insurance, HOA fees

Example Calculation:

Monthly Income: $6,000

Maximum Housing Cost: $1,680 (28% of $6,000)

Back-End Ratio: 36%

Total debt payments should not exceed 36% of gross monthly income

Includes: All housing expenses PLUS car loans, student loans, credit cards, personal loans

Example Calculation:

Monthly Income: $6,000

Maximum Total Debt: $2,160 (36% of $6,000)

Use our debt-to-income ratio calculator to instantly determine your DTI and see if you meet lender requirements.

How Much Can You Borrow for a Mortgage?

Your borrowing capacity depends on multiple interconnected factors. Lenders evaluate your complete financial profile to determine the maximum loan amount they're willing to approve.

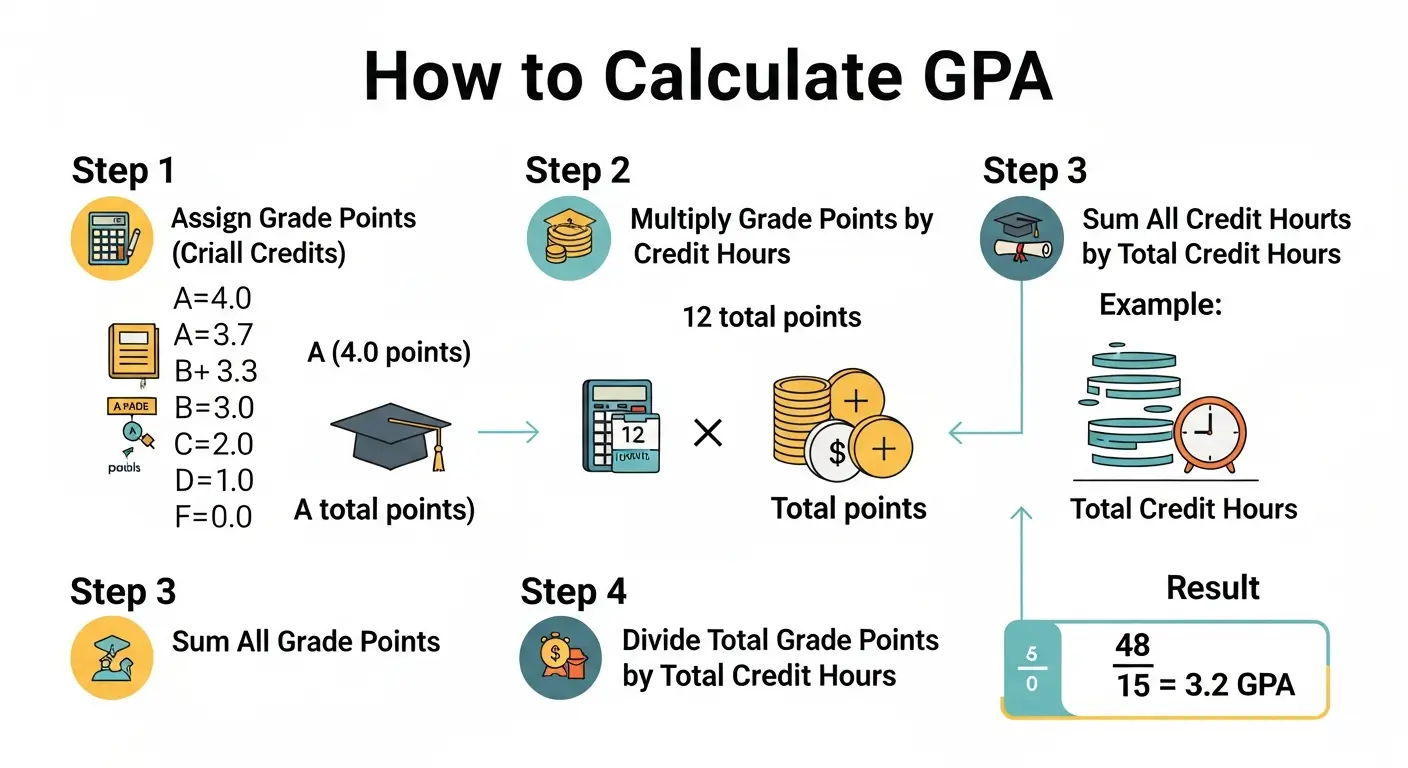

Step-by-Step: Calculate Your Maximum Loan Amount

- Calculate Monthly Income: Add up all sources of stable income (salary, bonuses, rental income, etc.)

- List Existing Debts: Total all monthly debt obligations (car payments, student loans, credit cards)

- Apply 28/36 Rule: Calculate maximum housing payment (28% of income) and ensure total debts stay under 36%

- Factor in Interest Rate: Current market rates directly affect how much principal you can borrow

- Consider Down Payment: Your available down payment determines the final home price you can afford

For location-specific calculations, explore our UAE mortgage calculator or UAE property loan repayment calculator for detailed regional insights.

How to Calculate Mortgage Payment: The Mathematical Formula

Understanding the mortgage payment formula empowers you to verify calculations and make informed decisions. The standard formula for a fixed-rate mortgage is:

Monthly Mortgage Payment Formula

M = Monthly mortgage payment

P = Principal loan amount (total borrowed)

r = Monthly interest rate (annual rate ÷ 12)

n = Total number of payments (loan term in years × 12)

Practical Example Calculation

Let's calculate the monthly payment for a $300,000 mortgage at 6.5% annual interest for 30 years:

- • P (Principal) = $300,000

- • r (Monthly rate) = 6.5% ÷ 12 = 0.00542

- • n (Total payments) = 30 years × 12 = 360 months

Monthly Payment: $1,896.20

Skip the manual calculations with our house payment calculator or home loan EMI calculator for instant, accurate results.

Special Mortgage Programs and Calculators

Different loan programs have unique requirements and benefits. Understanding these options helps you choose the best mortgage for your situation.

FHA Loans

Federal Housing Administration loans allow down payments as low as 3.5% with flexible credit requirements.

VA Loans

Veterans Affairs loans offer 0% down payment options for eligible military service members and veterans.

LIC Housing Finance

Specialized housing loan programs with competitive rates and flexible repayment terms for Indian homebuyers.

Accelerating Mortgage Payoff: Smart Strategies

Once you understand affordability, consider strategies to pay off your mortgage faster and save thousands in interest payments.

- Make Bi-Weekly Payments: Split monthly payment in half and pay every two weeks (equals 13 monthly payments per year)

- Round Up Payments: Pay extra $50-$200 monthly toward principal to reduce loan term significantly

- Apply Windfalls: Direct bonuses, tax refunds, or raises toward mortgage principal

- Refinance When Rates Drop: Lower interest rates can reduce payments or shorten loan term

Model different payoff scenarios with our mortgage payoff calculator to see potential interest savings.

Frequently Asked Questions

What percentage of income should go toward housing?

The standard recommendation is no more than 28% of your gross monthly income for housing expenses. This includes mortgage principal and interest, property taxes, homeowners insurance, and HOA fees. Staying within this limit helps ensure you have sufficient funds for other expenses and savings goals.

How does my credit score affect how much I can borrow?

Your credit score significantly impacts both loan approval and interest rates. Higher scores (740+) typically qualify for the best rates, potentially saving tens of thousands over the loan term. Lower scores may require larger down payments or result in higher interest rates, reducing the amount you can afford to borrow while maintaining the same monthly payment.

Should I get pre-approved before house hunting?

Yes, absolutely. Mortgage pre-approval gives you a clear budget range, strengthens your offers in competitive markets, and identifies any credit issues to address beforehand. Pre-approval involves a thorough financial review and provides a conditional commitment from a lender, making you a more credible buyer in sellers' eyes.

What's the minimum down payment I need?

Minimum down payments vary by loan type. Conventional loans typically require 3-5% for first-time buyers and 10-20% for others. FHA loans accept as little as 3.5%, while VA loans offer 0% down for eligible veterans. However, putting down at least 20% helps you avoid private mortgage insurance (PMI) and secures better interest rates.

Can I afford a house with student loan debt?

Yes, but student loans impact your debt-to-income ratio and reduce borrowing capacity. Lenders include student loan payments in the 36% back-end ratio calculation. To improve affordability, consider paying down student debt, increasing your income, or looking at income-driven repayment plans that may lower your monthly obligations and improve your DTI ratio.

Start Planning Your Home Purchase Today

Use our comprehensive mortgage calculators to determine exactly how much house you can afford and plan your path to homeownership with confidence.

Calculate Mortgage Now Explore All Calculators