📊 How to Calculate Income Tax in 2026

Complete Guide to Federal Tax Brackets, Deductions, Credits & Examples

📋 Table of Contents

🎯 Key Takeaway

Taxable Income = Gross Income − Deductions. Then apply the progressive tax brackets: the US uses 7 rates from 10% to 37%. You only pay each rate on income within that bracket, not your entire income.

1. Income Tax Overview

The US federal income tax system is progressive, meaning higher income is taxed at higher rates. Understanding how this works is essential for tax planning and financial decisions.

💡 Marginal vs Effective Tax Rate

- Marginal Rate: The rate on your last dollar of income (your tax bracket)

- Effective Rate: Your total tax ÷ total income (your actual average rate)

Types of income subject to federal tax:

- Wages, salaries, and tips

- Self-employment income

- Investment income (interest, dividends, capital gains)

- Rental income

- Retirement distributions

- Unemployment compensation

2. 2026 Federal Tax Brackets

2.1 Single Filers

| Tax Rate | Taxable Income Range | Tax Owed |

|---|---|---|

| 10% | $0 – $11,925 | 10% of income |

| 12% | $11,926 – $48,475 | $1,192.50 + 12% over $11,925 |

| 22% | $48,476 – $103,350 | $5,578.50 + 22% over $48,475 |

| 24% | $103,351 – $197,300 | $17,651.00 + 24% over $103,350 |

| 32% | $197,301 – $250,525 | $40,199.00 + 32% over $197,300 |

| 35% | $250,526 – $626,350 | $57,231.00 + 35% over $250,525 |

| 37% | Over $626,350 | $188,769.75 + 37% over $626,350 |

2.2 Married Filing Jointly

| Tax Rate | Taxable Income Range | Tax Owed |

|---|---|---|

| 10% | $0 – $23,850 | 10% of income |

| 12% | $23,851 – $96,950 | $2,385 + 12% over $23,850 |

| 22% | $96,951 – $206,700 | $11,157 + 22% over $96,950 |

| 24% | $206,701 – $394,600 | $35,302 + 24% over $206,700 |

| 32% | $394,601 – $501,050 | $80,398 + 32% over $394,600 |

| 35% | $501,051 – $751,600 | $114,462 + 35% over $501,050 |

| 37% | Over $751,600 | $202,154.50 + 37% over $751,600 |

2.3 Head of Household

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | $0 – $17,000 |

| 12% | $17,001 – $64,850 |

| 22% | $64,851 – $103,350 |

| 24% | $103,351 – $197,300 |

| 32% | $197,301 – $250,500 |

| 35% | $250,501 – $626,350 |

| 37% | Over $626,350 |

3. Standard & Itemized Deductions

3.1 Standard Deduction for 2026

| Filing Status | Standard Deduction | Additional (65+ or Blind) |

|---|---|---|

| Single | $15,000 | +$2,000 each |

| Married Filing Jointly | $30,000 | +$1,600 each |

| Married Filing Separately | $15,000 | +$1,600 each |

| Head of Household | $22,500 | +$2,000 each |

3.2 Common Itemized Deductions

You can choose to itemize if your deductions exceed the standard amount:

- State and Local Taxes (SALT): Up to $10,000 cap

- Mortgage Interest: On loans up to $750,000

- Charitable Contributions: Up to 60% of AGI

- Medical Expenses: Exceeding 7.5% of AGI

- Casualty Losses: From federally declared disasters

⚠️ Standard vs Itemized

About 90% of taxpayers use the standard deduction. Only itemize if your total itemized deductions exceed the standard deduction for your filing status.

4. Income Tax Formulas

4.1 Calculate Adjusted Gross Income (AGI)

📐 Formula: Adjusted Gross Income

Above-the-line includes: 401(k) contributions, IRA, student loan interest, HSA

4.2 Calculate Taxable Income

📐 Formula: Taxable Income

Choose whichever deduction method is larger

4.3 Calculate Tax Using Brackets

📐 Formula: Progressive Tax Calculation

Sum the tax from each bracket up to your taxable income

4.4 Calculate Tax Owed or Refund

📐 Formula: Final Tax Due

Negative result = refund; positive result = amount owed

5. Income Tax Calculator 2026

Estimate your federal income tax based on your income and filing status:

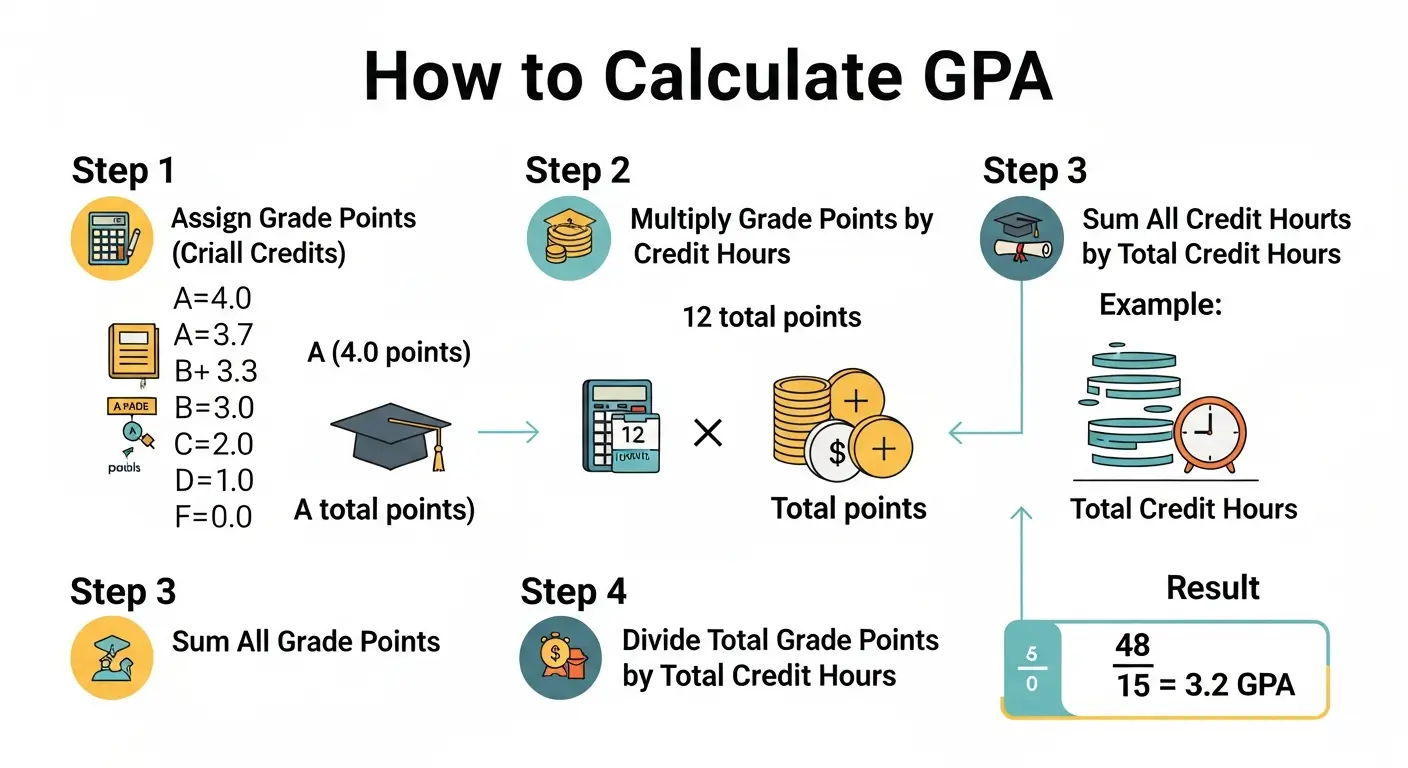

6. Step-by-Step Calculation Process

- Calculate Gross Income: Add all income sources (wages, investments, rental, etc.)

- Subtract Above-the-Line Deductions: 401(k), IRA, HSA, student loan interest = AGI

- Subtract Standard or Itemized Deduction: Use whichever is larger = Taxable Income

- Apply Tax Brackets: Calculate tax for each bracket progressively

- Subtract Tax Credits: Child Tax Credit, Earned Income Credit, etc.

- Subtract Withholdings: Taxes already paid = Tax Due or Refund

7. Worked Examples

Example 1: Single Filer with $75,000 Salary

📝 Problem

You earn $75,000 salary, contribute $6,000 to 401(k), and take the standard deduction. Filing single. What's your federal tax?

AGI = $75,000 − $6,000 = $69,000

Taxable = $69,000 − $15,000 = $54,000

10% on first $11,925 = $1,192.50

12% on $11,926–$48,475 = $4,386.00

22% on $48,476–$54,000 = $1,215.50

Total: $6,794

$6,794 ÷ $75,000 = 9.1% effective rate

Answer: Federal tax is $6,794. Marginal rate is 22%, effective rate is 9.1%.

Example 2: Married Couple with $150,000 Combined

📝 Problem

Married couple earns $150,000 combined, contributes $12,000 to 401(k)s, $7,000 to IRAs, standard deduction. Filing jointly.

AGI = $150,000 − $12,000 − $7,000 = $131,000

Taxable = $131,000 − $30,000 = $101,000

10% on first $23,850 = $2,385.00

12% on $23,851–$96,950 = $8,772.00

22% on $96,951–$101,000 = $891.00

Total: $12,048

Answer: Combined federal tax is $12,048. Marginal rate 22%, effective rate 8.0%.

8. Tax Credits That Reduce Your Bill

Unlike deductions (which reduce taxable income), credits directly reduce your tax bill:

💰 Major Tax Credits for 2026

- Child Tax Credit: Up to $2,000 per qualifying child

- Earned Income Credit: Up to $7,830 for families (varies by income/children)

- Child & Dependent Care Credit: 20-35% of up to $3,000/$6,000 expenses

- American Opportunity Credit: Up to $2,500 for higher education

- Lifetime Learning Credit: Up to $2,000 for education

- Saver's Credit: Up to $1,000 for retirement contributions

- EV Tax Credit: Up to $7,500 for qualifying electric vehicles

⚠️ Refundable vs Non-Refundable Credits

- Refundable: Can reduce tax below zero (you get a refund). Examples: EITC, Child Tax Credit (partially)

- Non-Refundable: Can only reduce tax to zero. Examples: Child Care Credit, Education Credits