🎓 How to Calculate Average Interest Rate on Student Loans in 2026

Complete Guide to Weighted Average Rates, Federal Loan Rates & Consolidation

📋 Table of Contents

🎯 Key Takeaway

Weighted Average Rate = Σ(Balance × Rate) ÷ Total Balance. This formula accounts for different loan amounts at different rates, giving you an accurate "blended" rate. Federal consolidation loans round up to the nearest ⅛%.

1. Why Calculate Your Average Interest Rate?

Understanding your average student loan interest rate is essential for:

- Evaluating refinancing offers — Only refinance if the new rate is lower than your weighted average

- Planning loan consolidation — Know what rate to expect after consolidating

- Budgeting for total interest — Estimate how much you'll pay over the loan term

- Prioritizing payoff strategies — Target loans with rates above your average first

- Comparing repayment plans — Understand true cost across different scenarios

💡 Simple vs Weighted Average

- Simple Average: Just averages the rates (ignores balance sizes) — NOT accurate

- Weighted Average: Considers both rate AND balance — The correct method

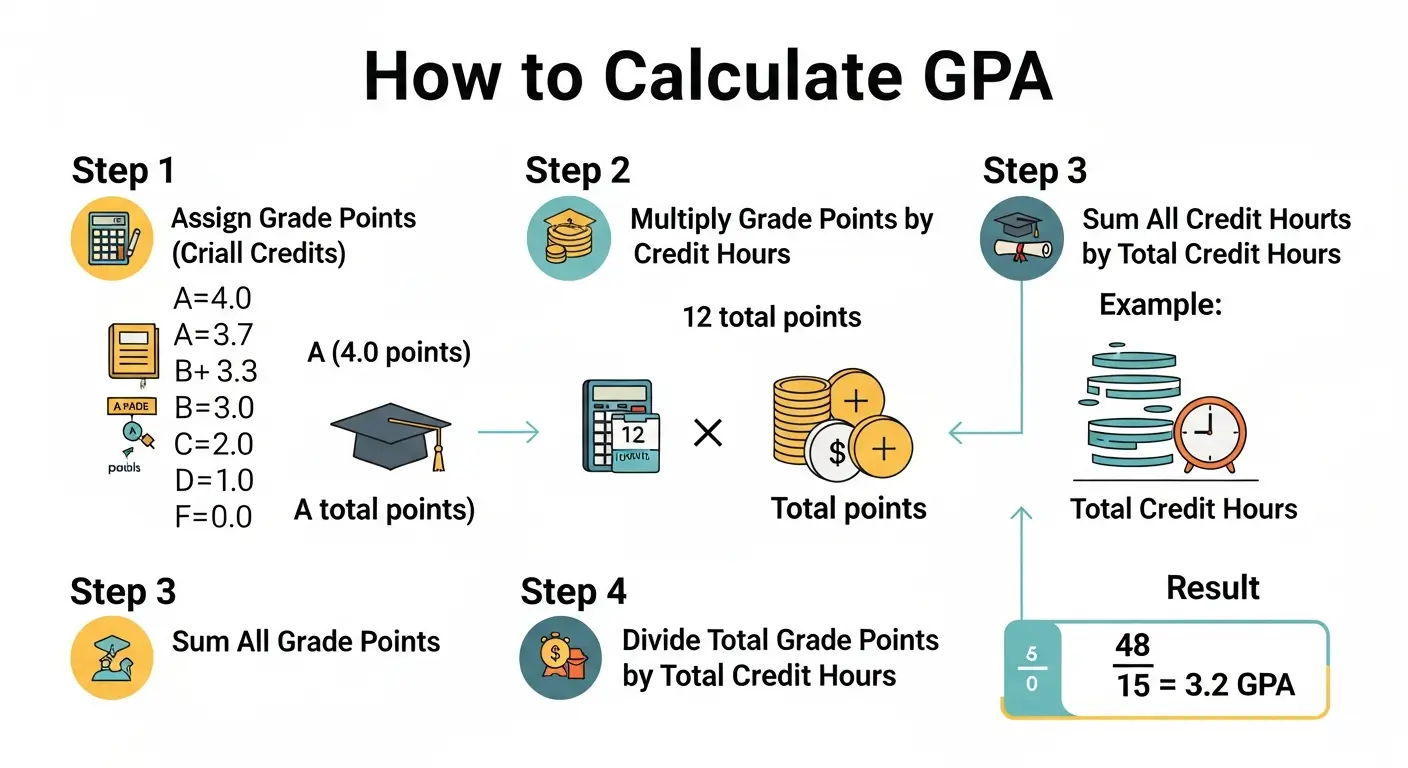

2. Weighted Average Interest Rate Formula

2.1 Basic Weighted Average Formula

📐 Formula: Weighted Average Interest Rate

Where B = loan balance and R = interest rate for each loan

2.2 Simplified Formula

📐 Formula: Simplified Version

Sum of (each balance × its rate) divided by sum of all balances

2.3 Federal Consolidation Rate Formula

📐 Formula: Federal Consolidation Loan Rate

Federal Direct Consolidation always rounds up, never down

3. Average Interest Rate Calculator

Enter your student loans to calculate the weighted average interest rate:

4. Worked Examples

Example 1: Two Loans

📝 Problem

You have two student loans:

• Loan A: $15,000 at 4.99%

• Loan B: $25,000 at 6.54%

Loan A: $15,000 × 4.99% = 748.50

Loan B: $25,000 × 6.54% = 1,635.00

Sum = 748.50 + 1,635.00 = 2,383.50

Total = $15,000 + $25,000 = $40,000

Average = 2,383.50 ÷ 40,000 = 5.96%

5.96% rounded up to nearest ⅛% = 6.00%

Answer: Weighted average is 5.96%. Federal consolidation would be 6.00%.

Example 2: Multiple Loans (4 Loans)

📝 Problem

Graduate with four loans:

• Subsidized: $5,500 at 4.99%

• Subsidized: $6,500 at 5.50%

• Unsubsidized: $12,000 at 6.54%

• Grad PLUS: $20,000 at 7.54%

$5,500 × 4.99% = 274.45

$6,500 × 5.50% = 357.50

$12,000 × 6.54% = 784.80

$20,000 × 7.54% = 1,508.00

274.45 + 357.50 + 784.80 + 1,508.00 = 2,924.75

$5,500 + $6,500 + $12,000 + $20,000 = $44,000

2,924.75 ÷ 44,000 = 6.647%

6.647% rounded up to nearest ⅛% = 6.750%

Answer: Weighted average is 6.647%. Federal consolidation rate would be 6.75%.

5. 2026 Federal Student Loan Rates

Current federal student loan interest rates for the 2025-2026 academic year:

| Loan Type | Borrower | Interest Rate | Disbursement Period |

|---|---|---|---|

| Direct Subsidized | Undergraduate | 6.53% | July 1, 2025 - June 30, 2026 |

| Direct Unsubsidized | Undergraduate | 6.53% | July 1, 2025 - June 30, 2026 |

| Direct Unsubsidized | Graduate/Professional | 8.08% | July 1, 2025 - June 30, 2026 |

| Direct PLUS | Parents & Graduate | 9.08% | July 1, 2025 - June 30, 2026 |

💡 Historical Context

Federal rates are set annually based on the 10-year Treasury note auction in May. Rates have ranged from 2.75% (2020-2021) to over 8% historically. Private loan rates vary by lender and credit score.

6. Loan Consolidation Guide

6.1 Federal Direct Consolidation

Federal consolidation combines multiple federal loans into one:

- Rate: Weighted average rounded UP to nearest ⅛%

- Term: Up to 30 years based on total balance

- Benefits: Single payment, access to IDR plans, PSLF eligibility

- Drawbacks: May lose some benefits, rate rounds up

6.2 Private Refinancing

Private refinancing replaces federal and/or private loans with a new private loan:

- Rate: Based on credit score, income, and lender

- Potential savings: May get rate below your weighted average

- Drawbacks: Lose federal protections, IDR, PSLF, deferment options

⚠️ Before Refinancing Federal Loans

Refinancing federal loans with a private lender means losing access to income-driven repayment plans, Public Service Loan Forgiveness, forbearance, and deferment options. Only refinance if you're certain you won't need these protections.

7. Interest Rate Reduction Strategies

💰 Ways to Lower Your Effective Rate

- Autopay discount: Most servicers offer 0.25% reduction for autopay

- Refinance with good credit: Private lenders may offer lower rates

- Pay extra toward highest-rate loans: Avalanche method saves interest

- Employer repayment programs: Some employers offer student loan benefits

- State-sponsored programs: Some states offer loan assistance

- Income-driven forgiveness: IDR plans forgive remaining balance after 20-25 years